NJ ST-13 2008 free printable template

Show details

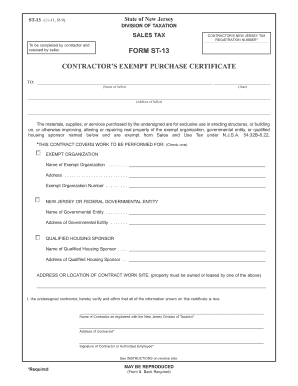

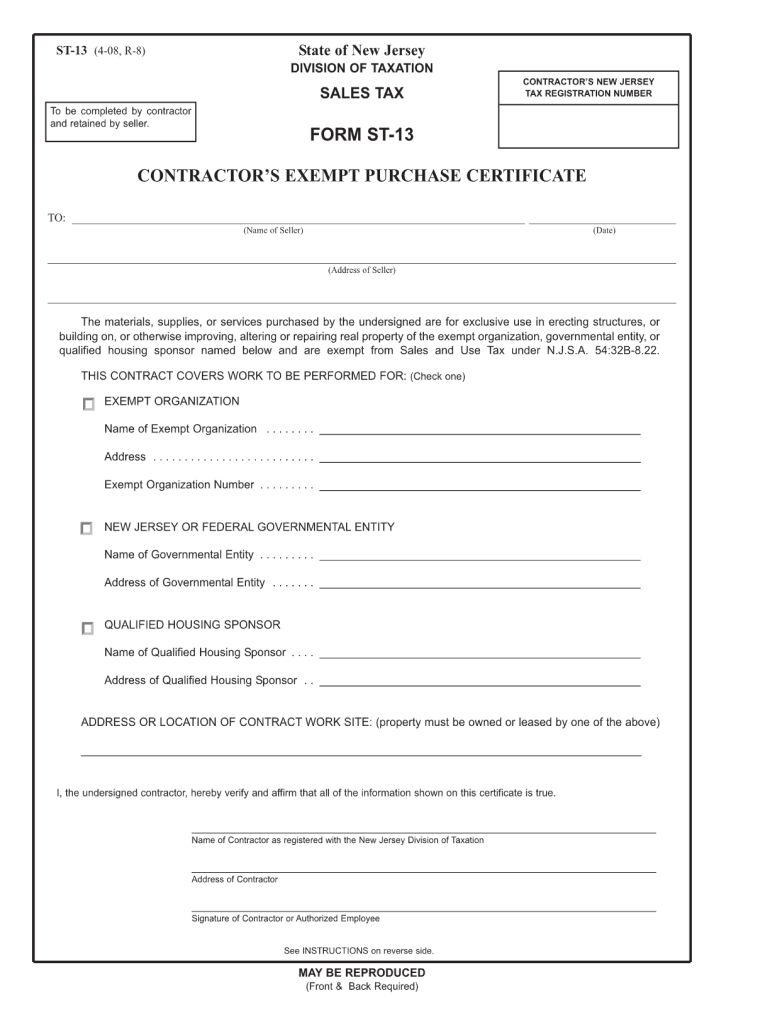

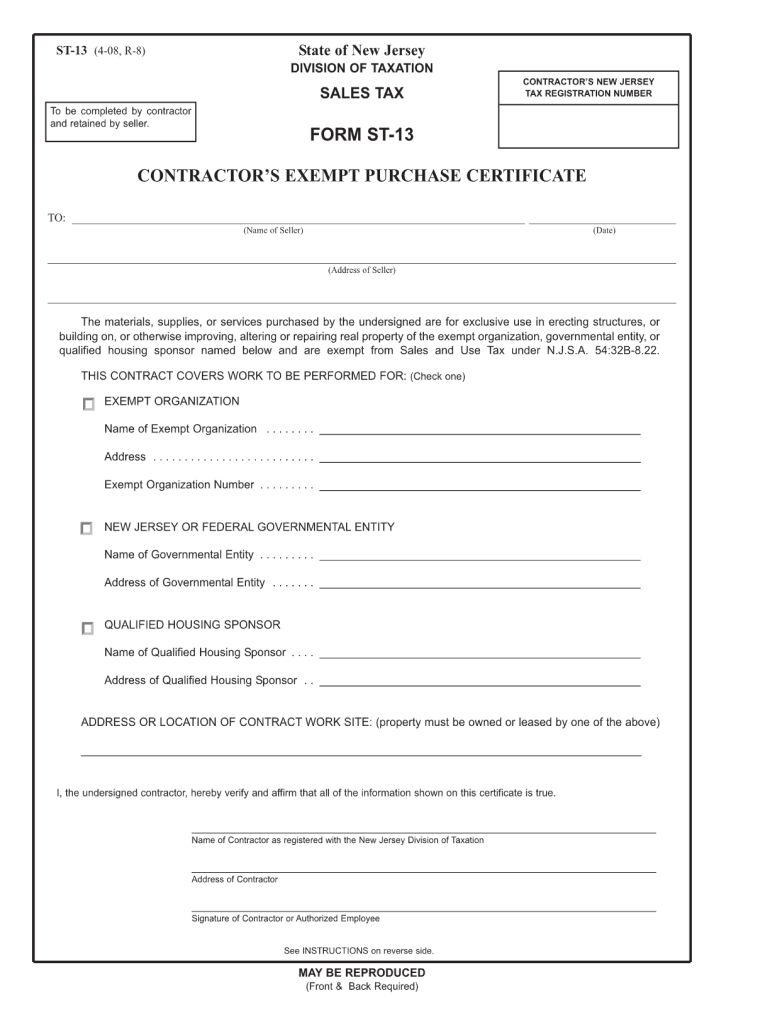

State of New Jersey ST-13 (4-08, R-8) DIVISION OF TAXATION SALES TAX To be completed by contractor and retained by seller. CONTRACTOR S NEW JERSEY TAX REGISTRATION NUMBER FORM ST-13 CONTRACTOR S EXEMPT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign st13 form

Edit your st 13 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nj st 13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nj st 13 form online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit st 13 nj form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ ST-13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form st 13

How to fill out NJ ST-13

01

Download the NJ ST-13 form from the New Jersey Division of Taxation website.

02

Provide your personal information including name, address, and taxpayer identification number.

03

Indicate the type of business entity you have (e.g., sole proprietorship, partnership, corporation).

04

Fill out the sections regarding sales and use tax liability.

05

Include details about your exemption or reason for not needing to collect sales tax.

06

Review the completed form for accuracy.

07

Sign and date the form before submission.

Who needs NJ ST-13?

01

Businesses or individuals who make sales or provide services in New Jersey and need to register for a sales tax exemption.

02

Tax-exempt organizations that wish to purchase items without paying sales tax.

03

Vendors who sell goods or services and may qualify for an exemption under NJ law.

Fill

nj tax exempt form st 13

: Try Risk Free

People Also Ask about nj st 13 fillable form

How do I get a PA state tax certificate?

THE PA DEPARTMENT OF STATE To obtain a Tax Clearance Certificate, the entity must complete and file an Application for Tax Clearance Certificate (REV-181). Entities are defined as a corporation, partnership or two or more individuals associated in a common interest or undertaking.

What is the tax exempt form in Massachusetts?

In order to claim an exemption from sales tax on purchases in MA, a copy of the Certificate of Exemption (Form ST-2) must be presented to the vendor at the time of purchase. In addition, Form ST-5 must be completed.

What is the tax exempt form for a church in Virginia?

Requirements for Nonprofit Churches Nonprofit churches have 2 options to request a retail sales and use tax exemption: Self-issued exemption certificate, Form ST-13A: Code of Virginia Section 58.1-609.10(16) allows nonprofit churches to use the self issued exemption certificate Form ST-13A.

How do I fill out a PA tax exemption certificate?

How to fill out a Pennsylvania Exemption Certificate Enter your Sales Tax Account ID on Line 3. Name of purchaser should be your registered business name. Address of purchaser should be the registered address of your company. Sign, enter your EIN and date the form.

What is the tax exempt form for NYC?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit fillable st13 for nj from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including form st 13 contractor's exempt purchase certificate, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in NJ ST-13 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit NJ ST-13 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out NJ ST-13 using my mobile device?

Use the pdfFiller mobile app to complete and sign NJ ST-13 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is NJ ST-13?

NJ ST-13 is a form used in New Jersey for claiming exemption from sales tax on certain purchases, typically for exempt organizations or specific types of transactions.

Who is required to file NJ ST-13?

Organizations that are exempt from sales tax, such as charities, non-profits, and certain governmental entities, are required to file NJ ST-13 to claim their tax-exempt status for eligible purchases.

How to fill out NJ ST-13?

To fill out NJ ST-13, provide the name and address of the purchaser, the type of exempt organization, the purpose of the purchase, and any relevant exemption number. Ensure all required sections are completed accurately.

What is the purpose of NJ ST-13?

The purpose of NJ ST-13 is to allow qualifying exempt organizations to claim exemption from sales tax on their purchases, thereby facilitating their operational funding and financial efficiency.

What information must be reported on NJ ST-13?

The information that must be reported on NJ ST-13 includes the purchaser's name and address, exemption type, purpose of the purchase, and the corresponding exemption number, if applicable.

Fill out your NJ ST-13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ ST-13 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.